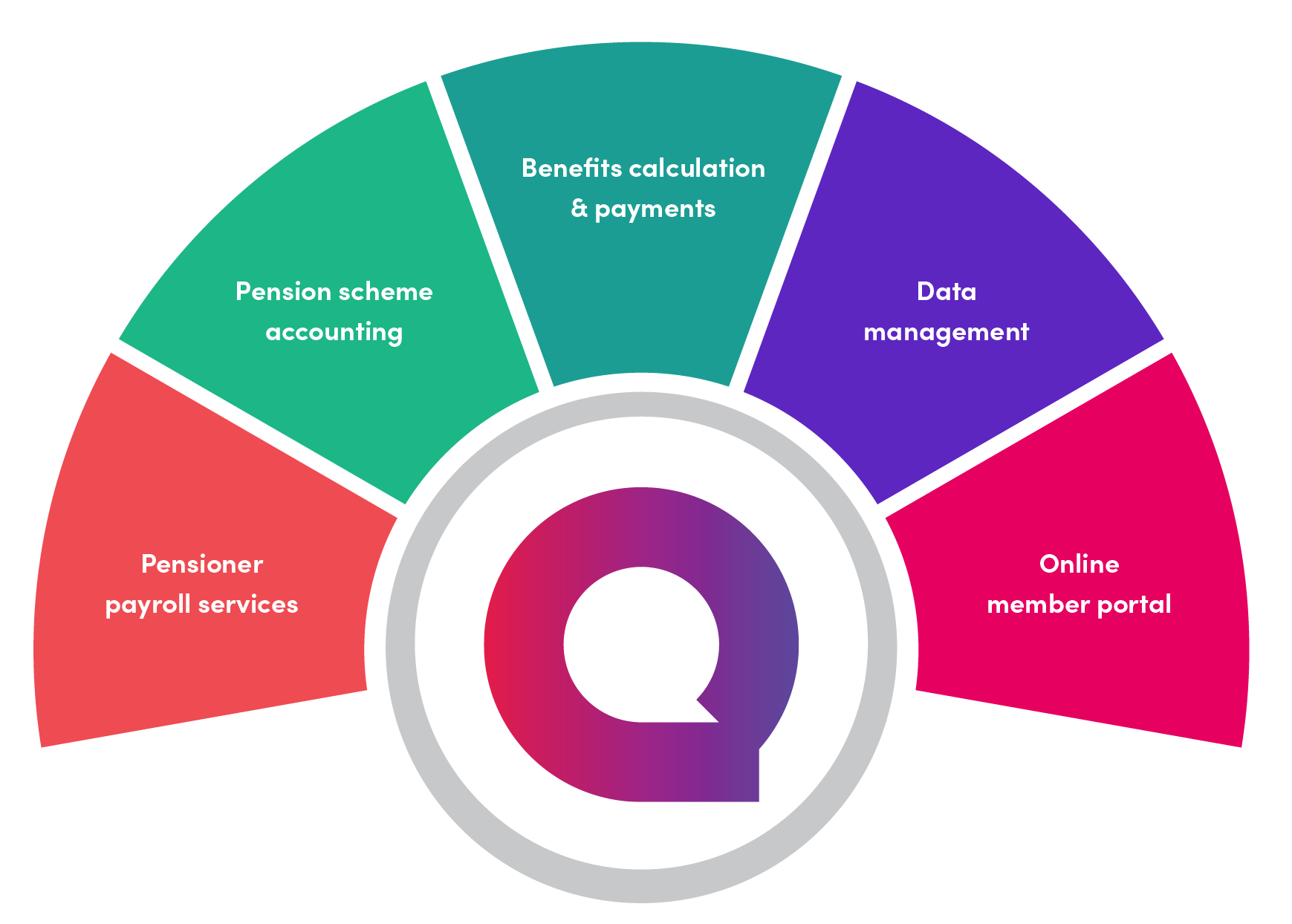

Pensions Administration

When pensions feel personal again. That’s the Quantum difference.

High quality pensions administration is vital for maintaining accurate member records, ensuring timely and correct benefit payments, complying with complex regulations and building trust and engagement with your members. Don’t let inefficient or unreliable administration cause costly errors, compliance headaches and frustrated members.

Partners in Confidence: Seamless Pensions Administration

Quantum Advisory delivers a big name service, on a first name basis for your pension scheme. We combine expert knowledge with a personal touch, acting as your trusted partner to ensure smooth and accurate administration, but always with the needs and best interests of your scheme and its members at the forefront.

High touch service meets down-to-earth pricing

- Tailormade technology: Innovative in-house technology to simplify scheme management, allowing for rapid improvements and updates to meet your evolving needs.

- Dedicated teams: You’ll have a designated administration team that understands your scheme inside out, building lasting relationships.

- Member-first approach: Our skilled and friendly UK-based team is directly accessible - without call centres or offshoring - so members can always speak to someone with knowledge of their scheme.

- Simplifying the complex: We keep things simple to ensure full understanding and confident decision making, always using clear, straightforward language with members.

- Joined up expertise: Our administration team works closely with our actuarial, investment and consulting experts for a seamless experience.

- Always improving: We’re constantly refining our processes to deliver a high-quality and efficient service, aligned to your requirements.

- Robust and accredited: Our procedures are audited annually (AAF01/20), and we hold ISO 9001 accreditation, giving you peace of mind.

By choosing Quantum Advisory for your pension administration needs, you can feel confident that your scheme and members are in expert hands. As your partners in confidence, you can expect smooth, reliable administration where your members are well looked after, ensuring superior member service and outcomes.

All schemes have access to our intuitive online member portal - Benefit Options.

Benefit Options allows members access to their pension information and scheme documentation at the click of a button. Benefit Options integrates directly with our pensions administration system allowing members to update personal information, review benefit calculations, directly message the administration team, and find relevant pensions information.

Accurate data management is the essential lifeblood of any pensions scheme, and the foundation on which everything else must be built. At Quantum we treat data management as the priority that it needs to be.

We have a specialist team of pensions data experts who use bespoke quality testing tools to validate and continually improve the data we hold, allowing it to be accessed and interrogated quickly and easily.

Not only does this facilitate efficient day to day administration, we can also undertake larger standalone projects such as:

- The Pensions Regulator quality reporting

- De-risking solutions

- Buy-in/buy-out projects

- Pensions Dashboard readiness and connectivity

Anyone can be the victim of a pension scam, no matter how savvy they think they are, and it is important to be able to spot the warning signs. We help combat pension scams by:

- Regularly warning members about pension scams.

- Encouraging members taking their benefits to seek impartial guidance and advice.

- Carrying out appropriate due diligence measures on pension transfers.

- Warning members about transfers that have been identified as being high risk.

- Report actual and potential pension scam activity to the relevant authorities.

Quantum Advisory has signed up to the Pensions Regulator’s pension scam pledge to help protect members from scam activity. To help members understand the risks involved in making a transfer, the ScamSmart leaflet on “pension scams” produced by the FCA and the Pensions Regulator can be found here.

Member testimonials

We recognise the importance of great customer service and our loyal clients and excellent member service are testament to our approach. In our most recent member survey, over 98% told us we’re meeting or exceeding their expectations.

All my dealings with Quantum Advisory have been prompt, efficient and professional. They have been perceptive and thorough in all their communication, always getting back as promised and keeping me informed of progress along the way. I am extremely happy with the level and quality of service from Quantum Advisory. Keep up the good work.

I could not praise this service highly enough. It was a real pleasure to deal with such a professional, helpful and efficient team.

Absolute first-class service and truly exceptional professionalism in dealing with my retirement and pension. Thank you very much for everything you have done for me.

When I rang for info I spoke to the same person who on every occasion was excellent.

Of my three occupational pensions, your admin process, proactive approach and time lines were the best so far!

For something so important as this in my life, it has been reassuring to trust the expertise of your organisation. You have excelled!

Talk to our team

Get in touch with our friendly team today to talk about how we can help your business.