Risk Transfer

Your plan. Our priority. That’s Quantum

As the focus of many organisations shifts towards Defined Contribution (DC) offerings, managing legacy Defined Benefit (DB) plans can become a significant drain on resources and a source of financial uncertainty. Fluctuating interest rates, longevity risk and administrative burdens can impact your balance sheet and distract from your core business activity. A pension risk transfer transaction can benefit organisations looking to derisk and redirect resources, whilst still delivering legacy obligations to members.

Partners in Confidence: Securing your future. Simplifying your present.

At Quantum Advisory, we have a deep understanding of the pressures faced by small and medium-sized organisations. We provide a big name service on a first name basis, acting as your partners in confidence to navigate the complexities of pension risk transfers to deliver the best possible outcomes for your scheme and members.

Our dedicated team of risk transfer experts, comprised of senior actuarial and investment consultants, data specialists, project managers and DC experts, bring extensive experience to every project. The team have relationships with and are in regular contact with all the key insurance companies and pension consolidators and so understand their appetite and capacity, meaning clients can focus their time and resources on providers able to deliver transactionable solutions in the timeframes required. We take the time to truly understand your business and your scheme’s specific needs, ensuring a tailored approach that aligns with your goals. And we believe in simplifying the complex, using clear and straightforward language to explain the options and guide you through every step of the journey.

With Quantum you get good people, providing high-quality, reliable and pragmatic risk transfer advice and services, at a price you can believe in. Allowing you to focus on your future with confidence, secure your employees’ benefits, and simplify your present.

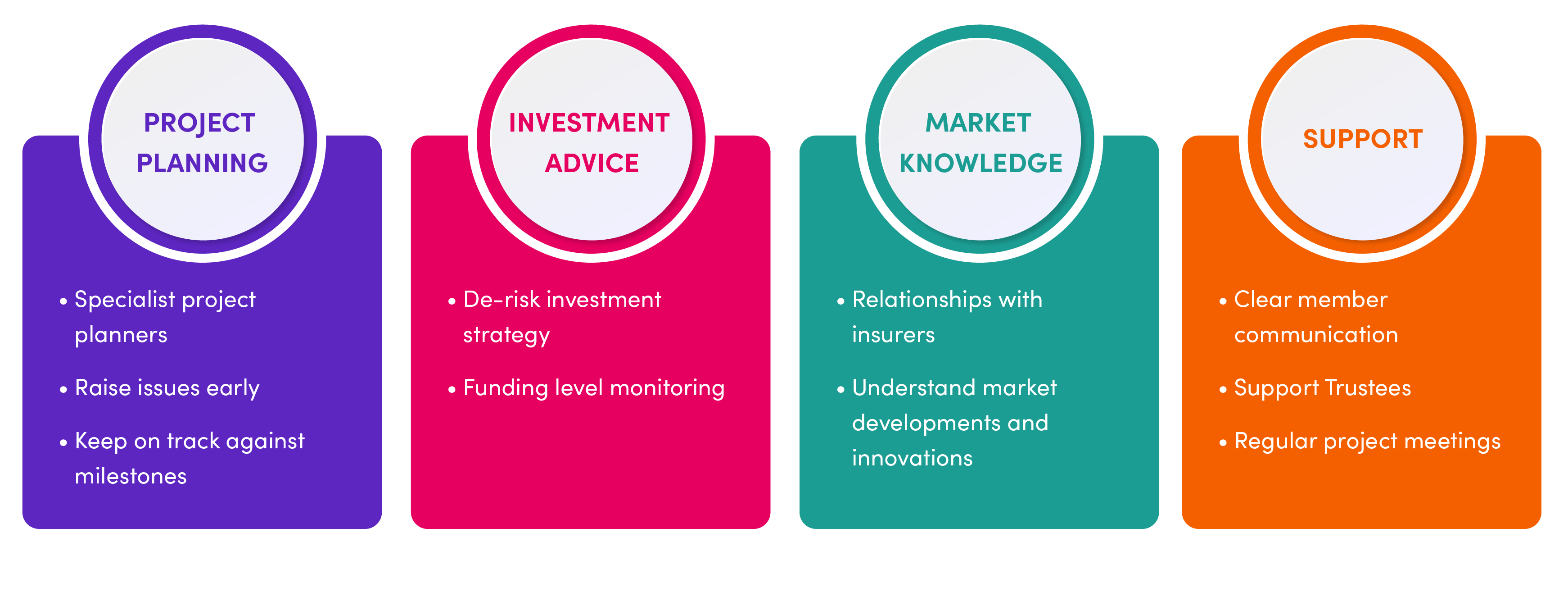

We have a packaged service ready to manage the risk transfer journey.

For any pension scheme considering a buy-in or buy-out transaction, preparation is key. There are several areas that trustees should be reviewing now to help any risk transfer project run smoothly and also to achieve the best pricing from the market including:

- Ensuring scheme documentation is in good order

- Preparation of a full, legally reviewed benefit specification

- Review of existing membership data and collect any missing data items

- Feasibility analysis

Not only will these steps save time and reduce costs, but they are also vitally important to enable schemes to demonstrate to the insurance market that they are serious about transacting when seeking quotations.

We actively monitor pricing across the market and provide regular updates on both insurer trends and pricing. Together with our advanced funding level monitoring for schemes, this work helps us identify pricing opportunities in the market and enables us to secure a quick transaction at the optimum price when these opportunities present themselves.

The risk transfer marketplace is constantly evolving, and the potential use of consolidation vehicles is one for consideration by trustees. Our knowledge of the market and early engagement with providers can help us demystify the options for schemes and advise trustees on all options.

We work with clients of all sizes to proactively manage their scheme liabilities in preparation for a risk transfer exercise. This includes undertaking pension increase exchange (PIE) and enhanced transfer value (ETV) exercises, which can deliver material reductions to scheme liabilities and by association funding obligations. We also assist with consolidating and simplifying complex benefit structures to make them easier for insurers to price attractively or administer.

Importantly, we consider your scheme’s long-term end game to ensure any liability management or consolidation exercise undertaken do not negatively impact any future buy-in pricing.

We provide expert advice on investment strategy at all phases of the risk transfer journey. Our goal is to align scheme assets with insurer pricing and minimise funding level volatility. This ensures you can effectively plan for a risk transfer exercise, achieve your funding target, and avoid falling short of the buy-in price. We work closely with insurers to manage price-locks between quotation and completion.

Case studies

Talk to our team

Get in touch with our friendly team today to talk about how we can help your business.